Here at StartupX, we have a bird’s eye view of some of the latest developments in the ecosystem, owing to our interactions with our ecosystem partners, our network and the work we do. COVID-19 has undoubtedly brought about changes that are here to stay, and in order to help the community be better informed and prepared about these, we’re attempting to share our knowledge and insights to help facilitate more informed business decisions for corporates and startups alike.

This article is part of our series analysing the areas where seasoned venture investors and large corporates chose to invest the big bucks and for what reasons, and this week, we’ll be looking at the consumertech industry, and more specifically, at E/S-Commerce.

(Image embedded from a BuiltIn article)

What is ConsumerTech

Consumertech is defined as any form of technology intended for use by ‘end consumers’ in the general public (as opposed to governmental/commercial use). Consumer tech thus encompasses many of the items utilised by you and I on a daily basis – everything from smartwatches to autonomous drones. Hence, it’s extremely difficult to compartmentalise or clearly define.

A Brief About the Industry

As a broad overview first, consumertech is one industry that has grown leaps and bounds on the back of the pandemic, as consumers looked for ways to keep themselves active, productive, and indeed entertained amidst global lockdowns. CVC investment in consumer-packaged goods (CPGs) grew 6% YoY in terms of the number of deals made (a slowdown from the growth rate of 19% in 2019), and grew 36.36% YoY in terms of the dollar value, after being unchanged in 2019. While CPG and D2C had been among the fastest-growing segments in recent years, the pandemic prompted VCs and CVCs to look elsewhere, notably towards the enablement side (infrastructure, logistics, virtual visibility) of these models.

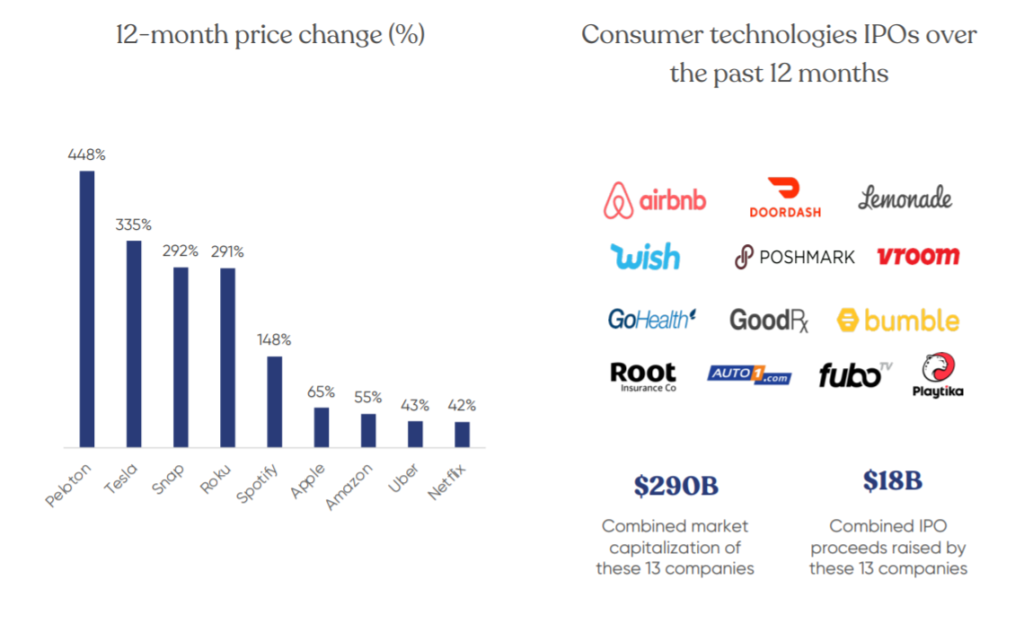

A bustling IPO market greeted these companies in 2020, and several consumertech firms took full advantage of it – A record 43 consumer companies went public in the US markets in 2020, a full 59.25% up by deal-count, with the gross offering figure ($19.57 billion) being higher than that of the previous 3 years put together! Existing public consumertech companies too, made waves, with their stock prices soaring over the past 12-16 months. However, with the market fast approaching the P/E levels of the dot-com bubble, a little caution and vigilance would not hurt.

(Image embedded from a Heartcore Capital report)

“We’re in one of those boom periods. Right now public markets are saying, ‘Hey, we’ve got the cash — come and get it!”

– James Angel, Professor of Finance at Georgetown University

Let us now deep-dive into our featured market/sub-industry for this article, E/S-commerce.

E/S Commerce

Investment Figures

The umbrella of retail tech saw investment levels rise modestly, with overall funding in the sector up 3% YoY to hit $47.7 billion. Within retail tech however, there were a lot of interesting movements, most notably in e-commerce enablement, and consumer engagement technology.

Companies that seek to “understand shoppers better” (such as Cosmose, Advertima, and Cooler Screens) saw a significant inflow of capital, as investment dollars rose 29% YoY to $517 million, and deals rose by 17%. E-commerce enablement, intuitively, saw a funding explosion, with deals jumping 53%, and total funding rising by 23% to clinch $8.2 billion.

Interestingly, both Europe (22%) and Africa (3%) saw their highest share of retail tech investments for the last half-decade. These came at the expense of Asia and North America, the latter of whom registered their lowest share (35%) in the same time period.

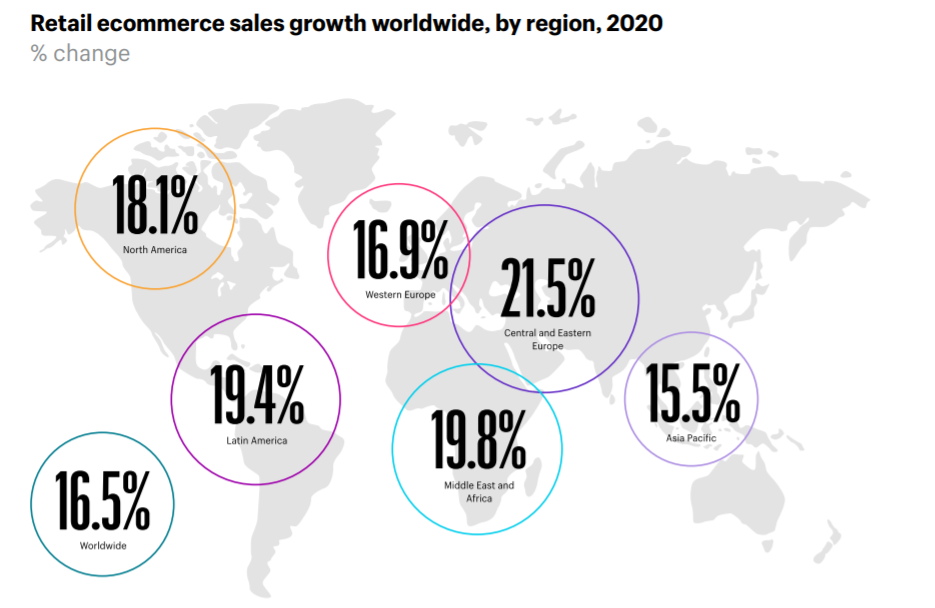

(Image embedded from a Shopify report)

Noteworthy Trends, Facts & Figures

Unsurprisingly, amidst global lockdowns, online channels profited, and brick-and-mortar stores were forced to digitise to stay relevant. This can be best summed up by the fact that global retail sales across all channels were up 1% YoY ($21.21 trillion), while e-commerce sales skyrocketed by 24%, and touched a peak of $4.29 trillion. They accounted for over 20% of total sales, and vindicated McKinsey’s assertion that e-commerce has accelerated the equivalent of 10 years in 8 weeks.

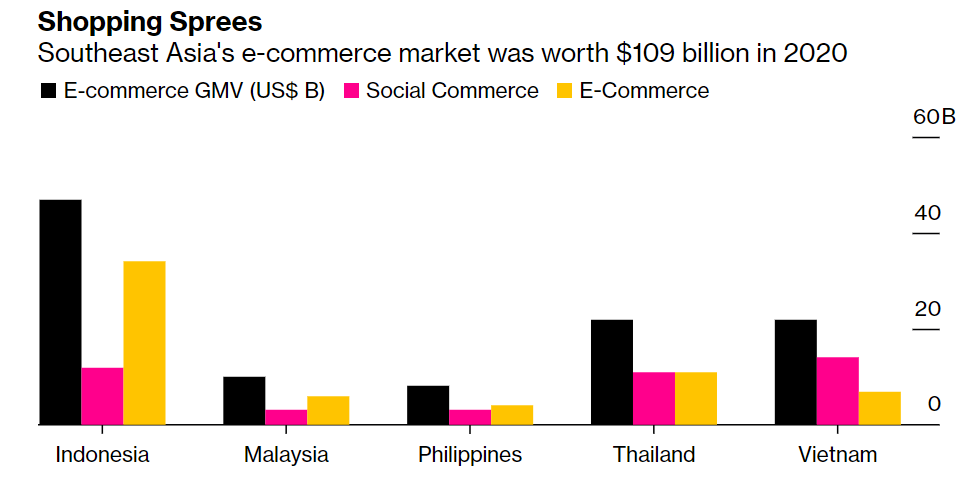

Within e-commerce, social commerce (S-Commerce) is on the ascendency. S-commerce is the practice of selling goods and services on social media channels directly, instead of marketing on social media to persuade the user to ‘click-through’ and buy elsewhere. Ergo, it creates a more seamless experience by allowing the user to check-out within the same network/platform and/or session. S-commerce accounted for 44% of SEA’s e-commerce market last year, and does not show any signs of slowing down, as represented by its CAGR (of the global market) of 31.4%.

(Image embedded from a Bloomberg article, citing a Bain & Co. report)

In China – S-Commerce’s undisputed leader – S-Commerce accounts for 13% of all e-commerce sales, and interestingly enough, is the country’s way of tackling high customer acquisition costs, via a strategy of ultra-high customer engagement, by putting buyers into direct contact with sellers, influencers and perhaps most explosively, live-streamers.

Companies Making Waves

Prominent social/messaging applications such as Line, Little Red Book, and WeChat have seen a flurry of large global brands register for accounts on these platforms, to taste a piece of the S-commerce pie. Line saw a 25% increase in official accounts in 2020, and Louis Vuitton garnered 152,000 views from their debut (1-hour) session on China’s Little Red Book in March ‘20; an outing that convinced the luxury brand to stick with an official account. This decision has been largely vindicated, as they presently sit atop the list of all official accounts, with 130,000 followers. The sales potential through these initiatives on such platforms is almost scary – just consider how 2 major influencers sold over USD 5 billion worth of merchandise in half a year!

(LV’s debut streaming session on Little Red Book – image embedded from a JingDaily article)

As mobile usurped live TV – best exemplified by Tik Tok’s explosion – it is no surprise that brands want to leverage this booming market to drive sales further. Luxury brands such as Burberry, Dior, Calvin Klein and more have recently become party to this trend by launching on WeChat. Transaction volume through WeChat’s mini-programs for the apparel industry tripled YoY in 2020, and search volumes for CK and Gucci 32x-ed and 10x-ed compared to the average during Chinese New Year ‘21, as WeChat’s million monthly active users looked to purchase something new for themselves and their loved ones.

Moving Forward

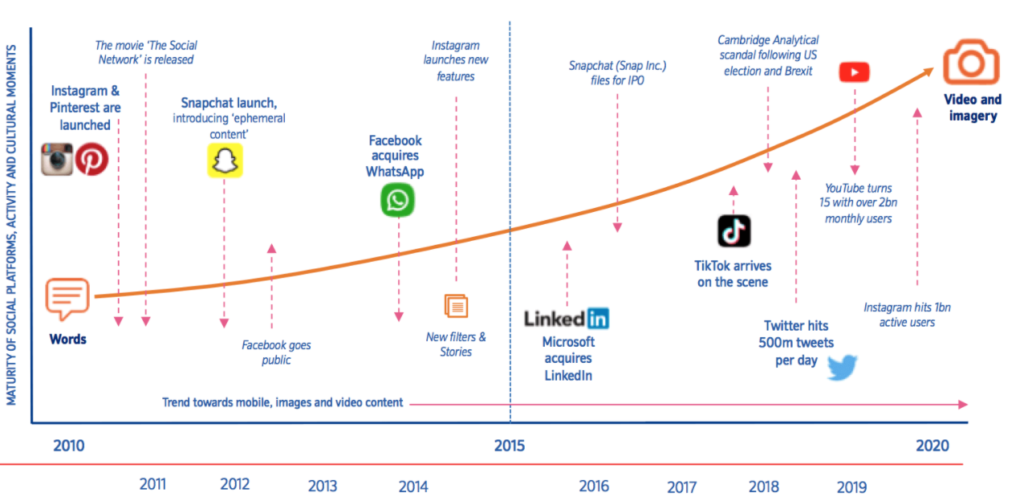

This trend will only continue moving forward, as salespeople and marketers alike recognise the potential of video, if not specifically S-commerce, and tailor a majority of their marketing and ad spend to cater to it.

Impact on key stakeholders

There’s definitely something to take away from these for different stakeholders. Let’s dive right into it:

Marketers and Social-Media Handlers: By 2022, over 82% of all online content will be video. While a good sense of humour and an awareness of memes was enough for brands to gain the public’s attention, it seems that today’s consumers prefer video-based content. Hootsuite’s survey cited that marketers’ top 3 social media priorities are customer acquisition (73%), increasing brand awareness (64%), and driving conversions (45%). All of these cater towards driving sales, and with people collectively spending 82 billion hours in shopping apps in 2020 (the biggest mobile shopping year to date, up 30% YoY), and also choosing mobiles as their preferred platform for streaming services, live-streaming and video content should be at the forefront of every company’s marketing budget. Furthermore, these must be optimised for mobile browsing/viewing. The market looks set for further acceleration as social commerce (via Pinterest, Instagram and others) goes mainstream (especially in the west).

(Image embedded from a SmartInsights article)

Last-mile Intelligence Providers: Logistics, and specifically, last-mile intelligence providers look set to be in high demand, as consumers across the world demand convenience and seamless alignment with their schedules. Just consider how 66% of millennials desire 1-hour delivery options in metropolitan areas, or how 90% of shoppers track their order’s delivery status, and believe delivery needs to fit in with their hectic lifestyles, characterised by ‘WFH’ and ‘contactless’ considerations. What’s more, 45% of customers will abandon a purchase if there isn’t a convenient delivery option, and 95% will shop elsewhere if fulfilment options don’t suit their needs. Whether it’s through drones, analytics, or innovative supply-chains, optimising the last mile looks to be on course to become a priority for today’s e-commerce players.

(Image embedded from an Accenture report)

Investors: Venture investors know that the e-commerce pie just got a whole lot bigger, as online and BOPIS options were the only choices available to consumers. With that in mind, VCs are looking for companies who can show concrete plans to retain this critical mass, as economies reopen. This partly explains why investment towards tech-based loyalty and rewards programs jumped by over 50% YoY!

To sum up, user experience and fulfilment will be the key differentiating factors that separate the winners from the losers. And given the general trends towards gaming, live-streaming and social networking/interaction, brands that adopt gamification and video-centric content (optimised for mobile), and prioritise retention over acquisition may be best suited to emerge from the pandemic stronger.