Institutional investors and members of the public alike have been flocking to put their money in SPACs ever since they have re-emerged as the hottest new investment vehicle in town. Chances are, you’ve probably already heard a family member, friend or a coworker proudly mention their new investment in a SPAC.

But what does it really mean to invest in a SPAC? How does one invest in a SPAC?

Trevor Milton, CEO and founder of Nikola. Source: Massimo Pinca/Reuters [1]

From the SPAC’s IPO

An investor can purchase units in a SPAC from the Initial Public Offering (IPO) itself. Investors receive units in exchange for their capital, with each unit consisting of a share of common stock of the SPAC and a warrant to buy more shares in the future. The price that investors pay for each unit (share + warrant) is usually $10.

Such warrants given to initial SPAC investors are essentially rights to pay an additional specified sum to purchase more common stock in the future. The specified price of buying these additional shares under a warrant are slightly higher than the IPO price of a unit (e.g. $11.50, which is higher than $10). However, these warrants serve as additional compensation to the initial SPAC investors because if the share price of the SPAC shoots up after the merger announcement, the holders of warrants can buy more shares of the SPAC at the specified price (e.g. $11.50 only).

Post-IPO

Post-IPO, investors can also purchase SPAC shares trading publicly on the stock exchange pre-merger: when the listed SPAC has not announced its acquisition deal yet, or when the SPAC has announced its acquisition target and the merger has not been completed. The shares will be under the SPAC’s ticker symbol on the stock exchange and will trade at the SPAC’s market price on the stock exchange.

Subsequently, when the merger is completed, the shares of the SPAC and their ticker symbol in an investor’s account will automatically be changed to that of the merged company and its new ticker symbol. For example, investors who bought shares of the SPAC VectoIQ Acquisition (former NASDAQ: VTIQ) had their shares converted to that of Nikola Corp. (NASDAQ: NKLA) after VectoIQ completed its acquisition of Nikola. [2]

What happens to investors’ capital?

After the IPO, when SPACs receive capital from investors, all of the IPO proceeds will be deposited in an interest-bearing trust account. This means that the investors’ money is “safe” – the SPAC can only use the proceeds in the trust account for acquiring a company.

If the specified period for acquiring a company has expired and the SPAC has not acquired a company, it must return the funds back to the investors. Of course, the funds returned include interest generated on them, but any underwriting or brokerage fees are deducted from the funds.

Make no mistake – there have been SPACs which have failed. For example, the SPAC Allegro Merger terminated its merger agreement with TGI Fridays – the American casual dining chain, due to extraordinary conditions caused by COVID-19 and failing to meet necessary closing conditions. [3] Allegro Merger thus liquidated and returned the US$130 million initially raised back to investors.

Risks of investing in a SPAC

Firstly, investors have no knowledge or certainty of what company the SPAC will acquire at the point of investing in a SPAC. This is why a SPAC is commonly known as a “blank check company”, because the SPAC has freedom to choose its acquisition target – which investors have limited control over. Essentially, investors are betting on the SPAC’s sponsors to make a good acquisition.

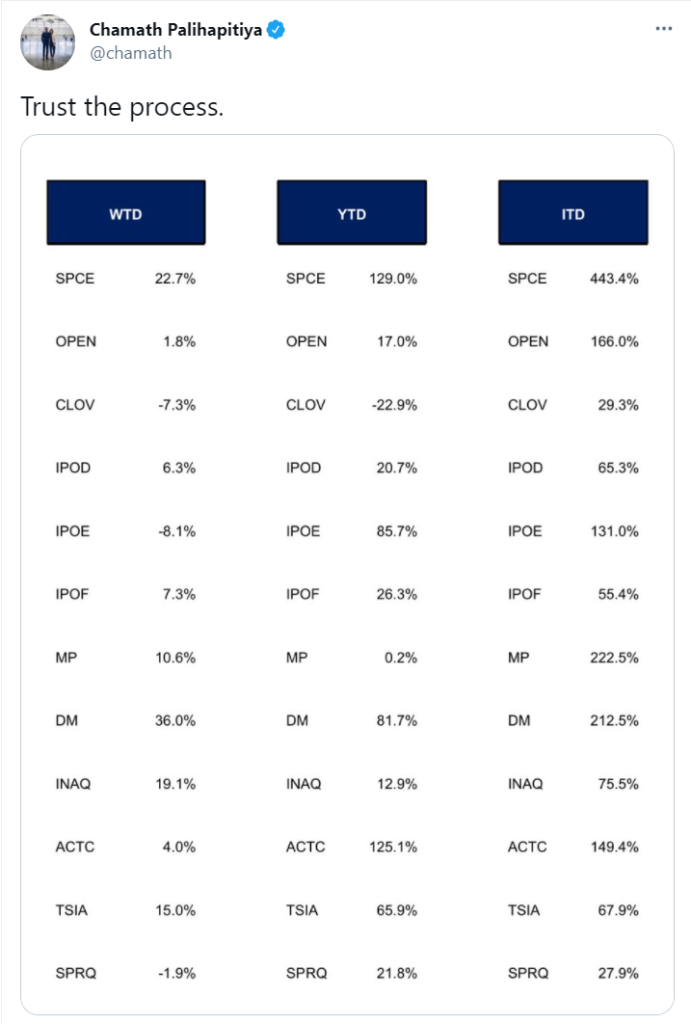

One way to mitigate this risk is to invest only in SPACs where the sponsors have industry expertise or a track record in making successful investments. For instance, the proclaimed “King of SPACs” Chamath Palihapitiya has been involved in 12 SPAC deals. These 12 SPAC deals have produced a substantial 46.95% return on average for investors in 2021 so far – definitely something he found to be worth tweeting about. [4]

Source: Twitter (@chamath)

Secondly, SPAC sponsors may make bad investment decisions that they would not otherwise make due to the nature of a SPAC deal. There is a specified duration within which the sponsors must make an acquisition – or else the SPAC is liquidated and the IPO proceeds are all returned back to the investors. Hence, SPAC sponsors are pressured (and incentivised) to make an acquisition within the specified time period, regardless of whether the target company was in fact the best acquisition for the SPAC. Additionally, the SPAC sponsors may potentially pay more than what the target company is worth for the acquisition, because the value of the target company must be at least 80% of the SPAC’s trust assets – the capital that investors have put into the SPAC (at least in the United States).

Thirdly, there may be dilution to SPAC investors. Share dilution occurs when a SPAC issues additional shares, thus reducing a current shareholder’s percentage of ownership in the SPAC. Dilution stems from a few sources such as the SPAC sponsors receiving their own cut of SPAC shares as “promote” for setting up the SPAC, which is shares equivalent to 25% of the SPAC’s IPO proceeds. The amount of capital contributed into the SPAC by the sponsor itself (“sponsor capital”) is disproportionately small compared to the value of the promote they are receiving.

Additionally, where warrant holders exercise their warrants to purchase additional shares, the total number of issued SPAC shares increases, and thus the percentage ownership of existing shareholders in the SPAC decreases. Altogether, it is estimated that the sponsor’s promote, warrants and rights for investors, and underwriter’s fees cost about 14% of the total post-merger equity value in general.

Elon Musk’s caution against SPACs? Source: Twitter (@elonmusk) [5]

The advantages

Recall that IPO proceeds contributed by investors are placed into a trust account – if the SPAC fails to acquire another company at the end of the specified period, this money is returned to investors. Hence, the downside risk for investors is significantly eliminated, in that investors are protected from losing their initial investment if the SPAC deal eventually fails.

Initial investors in the SPAC at its IPO may have an attractive payoff, because their warrants allow them to buy additional shares at a relatively low price if the SPAC turns out to be a success. Additionally, this may allow initial investors to own a larger percentage of the eventual merged company through a SPAC deal than they would have been able to in a company undergoing the traditional IPO process. [7] This is because there is usually high demand for shares in a traditional IPO and the number of shares that investors receive in a traditional IPO is generally less than what they applied for.

However, while initial IPO investors receive units consisting of both shares and warrants, an investor who subsequently purchases the SPAC’s shares after its IPO on the stock exchange does not receive warrants. This will probably be less advantageous than buying units during the SPAC’s initial IPO.

DraftKings is listed on the NASDAQ. Source: NASDAQ [6]

The verdict

It is true that certain high-profile SPACs have produced decent returns for investors post-merger, such as Draftkings (NASDAQ: DKNG) and Virgin Galactic (NYSE: SPCE). However, between 2015 – 2020, generally SPAC IPOs have on average underperformed post-merger as compared to companies which underwent the traditional IPO process. These outperformers could simply be outliers, or led by specific sponsors who are experienced and highly skilled.

It is difficult not to jump onto the SPAC bandwagon especially given the extensive media spotlight given to SPACs. Even celebrities are getting involved – for example, hip-hop mogul Jay-Z partnering with a SPAC to form a new vertically-integrated cannabis company [8], and basketball hall-of-famer Shaquille O’Neal serves as a strategic adviser on the SPAC Forest Road Acquisition Corp II (NYSE: FRXB). [9]

Ultimately, it is still up to investors to do their own due diligence before investing in SPACs. While there are potential diamonds in the rough in the SPAC world, it seems like SPACs still have an unsatisfactory historical track record for investors – whether that changes in the future remains to be seen.

To quote Piers Morgan: “One day you’re the cock of the walk, the next you’re the feather duster”. This hype over SPACs could eventually end, but it seems like this trend remains strong going forward. [10] At least for now, SPACs look like they are here to stay.

[1] NBC News (2020): https://www.nbcnews.com/business/business-news/trevor-milton-founder-public-face-nikola-motors-steps-down-amid-n1240591

[2] NASDAQ (2020): https://www.nasdaq.com/articles/electric-vehicle-startup-nikola-set-to-begin-trading-under-symbol-nkla-following-spac

[3] NASDAQ (2020): https://www.nasdaq.com/articles/tgi-fridays-will-no-longer-become-a-public-company-as-allegro-merger-ends-acquisition-2020

[4] Twitter (2021): https://twitter.com/chamath/status/1357819830884204544

[5] Twitter (2020): https://twitter.com/elonmusk/status/1329483695493931009

[6] NASDAQ (2020): https://www.nasdaq.com/articles/latest-spac%3A-insight-into-draftkings-listing-2020-04-27

[7] NASDAQ (2020): https://www.nasdaq.com/articles/updated%3A-spac-returns-fall-short-of-traditional-ipo-returns-on-average-2020-10-01

[8] Business Wire (2020): https://www.businesswire.com/news/home/20201124005792/en/Subversive-Capital-Acquisition-Corp.-the-Largest-Cannabis-SPAC-in-History-Announces-Transaction-with-Shawn-%E2%80%9CJAY-Z%E2%80%9D-Carter-Roc-Nation-Caliva-and-Left-Coast-Ventures

[9] Forbes (2020): https://www.forbes.com/sites/korihale/2020/10/20/shaq-moves-into-spacs-with-former-disney-execs–mlk-jrs-son/?sh=5b5827066c77

[10] CNBC (2020): https://www.cnbc.com/2020/12/07/the-2021-outlook-for-the-booming-spac-market-and-traditional-ipos.html