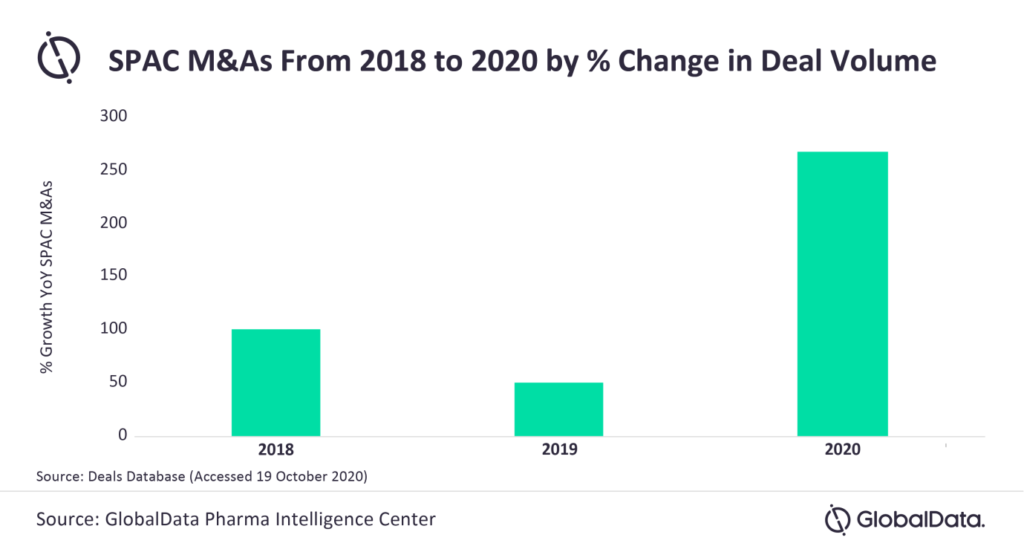

COVID-19 has disrupted many aspects of the world we know, and how companies raise money has not been an exception. The pandemic has disrupted the IPO process that companies traditionally use to raise money publicly and has contributed to the rising popularity of Special Purpose Acquisition Companies (SPACs). In fact, the volume of SPAC deals for biotech startups has skyrocketed since the COVID-19 pandemic struck, with a 250% increase in SPAC deal volume in 2020 as compared to 2019.

Source: GlobalData [1]

So why do such companies turn to SPACs as vehicles to raise capital publicly?

Carousell’s co-founders Quek Siu Rui, Lucas Ngoo and Marcus Tan. Source: Vulcan Post [3]

Benefits of going public via SPACs

There are several reasons why these companies are considering SPACs over the traditional IPO route.

Cost. Raising capital by public listing is no mean feat – it requires many third-party service providers to complete. Thus, third-party service fees are invariably incurred and are a key concern for companies seeking to raise funds publicly. For SPACs, the sponsors usually pay 2% of the proceeds as underwriting fees when the SPAC undergoes the IPO, and the combined company pays another 3.5% to the underwriter after the SPAC completes the merger with the target company (the “De-SPAC” process). In contrast, for a traditional IPO, fees incurred can include underwriting, legal, auditing, administrative fees which amount to about 7% of the total IPO proceeds. Additionally, all these fees are paid by the IPO company itself. Hence, we can see the fees borne by a company seeking to list via a SPAC can be substantially less than if it underwent a traditional IPO.

Time. It is much quicker to complete a SPAC deal than for a company to complete a traditional IPO. For SPACs, typically the entire process could require as little as 3 to 8 months. Conversely, IPOs could take up to 1 to 3 years to complete. Recall in SPAC deals, the SPAC shell companies are ones actually being listed and they have no actual business operations themselves, so financial statements and prospectuses filed during SPAC IPOs are shorter. This means that there are less things to disclose by the SPAC and thus this requires less regulatory scrutiny. However, for companies undergoing the traditional IPO route, these companies which have actual business operations are the ones which are actually listing themselves. Hence, more detailed financial statements and prospectuses have to be submitted and subject to regulatory approval by authorities.

Flexibility in negotiation. For SPAC deals, since the merger occurs between the listed SPAC and the target company (rather than the investors), there is greater flexibility for the target company to negotiate more favourable deal terms. These could include, for example, additional PIPE investments by private investors, and powers to appoint directors etc. Conversely, for traditional IPOs, there is no real room for negotiation between the company seeking to list and the investors. If investors find the terms listed in the company’s IPO prospectus to be unfavourable, they simply stay away from the IPO and choose not to invest.

Access to expertise and support. A company seeking to list via a SPAC can get access to the experienced management teams of the SPAC sponsor, which may bring industry expertise and general business support to the company. For example, Grab’s SPAC deal allowed it to gain access to the sponsor Altimeter Capital Management’s expertise and assistance in the merger process (Altimeter is a Silicon Valley tech-focused investment firm).

Grab Holdings’ merger with the SPAC of Brad Gerstner’s (above) Altimeter Capital Management. Source: Bloomberg [4]

Disadvantages of going public via SPACs

Do SPACs seem too good to be true?

Perhaps sometimes the adage “if it ain’t broke, don’t fix it” still holds true – traditional IPOs may still be preferable owing to certain risks that going public via SPACs holds.

Dilution of shareholding. Recall that SPAC sponsors receive a “promote” in exchange for creating the SPAC vehicle. This “promote” consists of shares equivalent to a portion of the SPAC’s total IPO proceeds (usually about 20% of the total post-IPO equity of the merged company).

Wary or less committed investors. First, many investors in SPACs may not actually care much about the company which is acquired by the SPAC – so they may not be long-term investors, but rather short-term ones looking to flip the shares in the merged company after it goes public. After all, they are investing “blind” in a blank-cheque SPAC prior to acquisition, which may mean the company that eventually merges with the SPAC doesn’t really matter to them as much. Also, due diligence is not performed as strictly for SPAC deals compared to traditional IPOs, because there is less regulatory scrutiny on SPACs. This could be a double-edged sword – although this allows companies to go public via SPACs faster than via traditional IPOs, it also could make investors more wary in buying shares of a company that went public through a SPAC due to the less amount of due diligence required for a SPAC deal compared to a traditional IPO.

Going public too fast, too soon. It is certainly tempting for up-and-coming tech startups which are looking to get themselves noticed in the public investing scene to go public fast, due to the relative ease of raising funds publicly via SPACs. Sometimes, such startups are jumping the gun when they have not even built a strong and constant revenue stream yet, much less being profitable. As a public company, regulatory, reporting and compliance costs will definitely increase, adding to the strain on the company’s ability to be profitable. Accountability to numerous public investors will arise, and this additional pressure may cause the newly-public company to focus more on short-term rather than long-term results, hindering the company’s development and growth.

The New Norm?

There is undeniably a high investor appetite for high-growth tech companies today amidst today’s uncertainty in a world which is still grappling with COVID-19. With their digital-driven business models which are more resilient and possess higher growth potential, it is no mystery why investors are willing to throw their money at just about any exciting tech company that has landed itself in the spotlight.

While it is definitely easier now for young tech companies to go public due to the ease of the SPAC process and also the general investor optimism in technology companies and SPACs, it is important for a company to consider the risks involved. Not every company is suited for a SPAC IPO, or even ready for a public listing in the first place.

In the end, SPACs are merely a tool, a means to an end – getting public financing. It is the workman who has to determine whether it is the right tool to use for the project at hand – and that makes all the difference.

[1] https://www.globaldata.com/covid-19-caused-250-surge-special-purpose-ma-deal-volume-biotech-space/

[2] https://sg.finance.yahoo.com/news/singapore-carousell-explores-us-listing-via-spac-093320168.html

[3] https://vulcanpost.com/750816/carousell-us-listing-spac-merger/

[4] https://www.straitstimes.com/business/companies-markets/grabs-spac-vehicle-altimeter-hovers-near-record-low