Throughout the years, we’ve seen and heard startups being labelled with terms that often come from the animal kingdom (one might be a mythical creature). Labels like unicorns and camels seem to have shot up and gained interest over the years. We all love our labels— they sound good, make for a great short-cut to convey something and above all, add that extra bit of glamour. But if we look closely at these words and all the associated buzz around them, we’d see that something is clearly rotten in the startup world. These labels have misguided many startups as they’ve been misconstrued and have lost their true meaning over time. It’s about time we started talking about losing the labels altogether and start focusing on what truly matters.

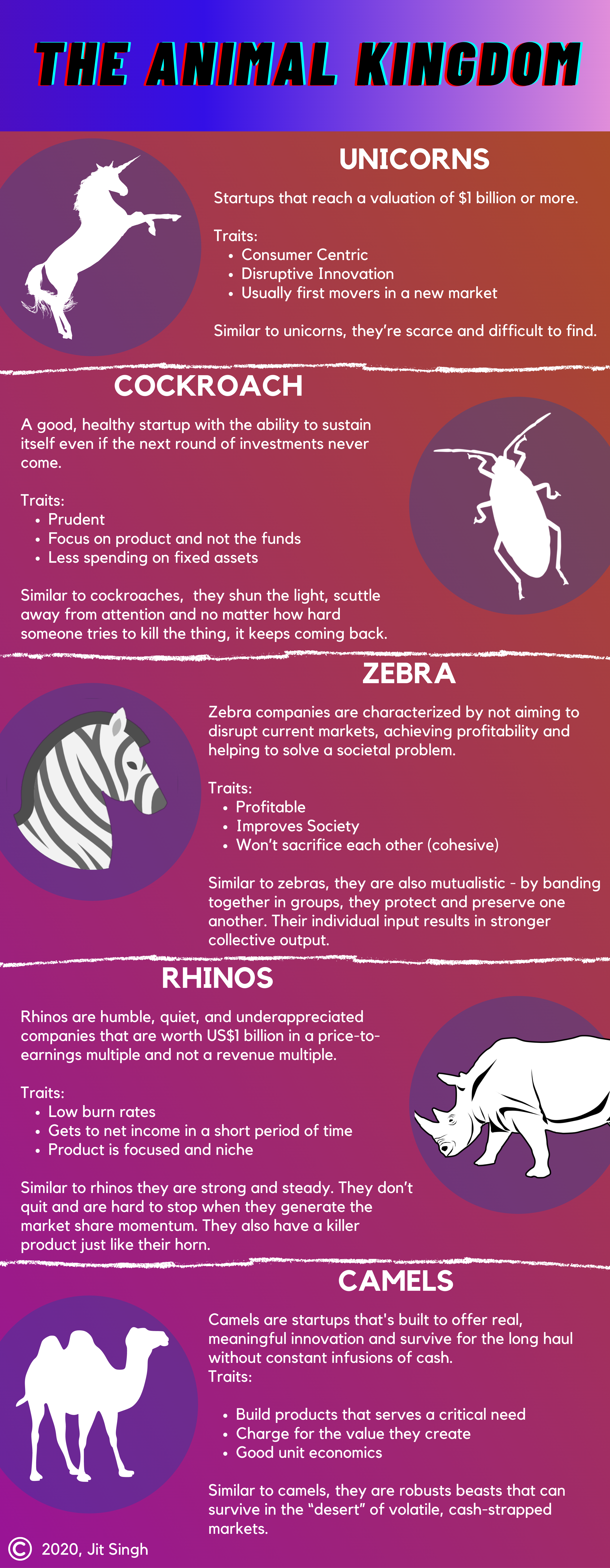

The Animal Kingdom

To help you better understand these labels, let us first take a look at some of the common ones and dissect what they truly mean. A common trend you’ll see is that they’re all labelled after animals. Much alike to the startup world, the animal kingdom is made up of some strong personalities that exhibit unique characteristics and traits. We have seemed to liken them to the traits that stand out with certain startups.

However, the discovery of these animal labels did not happen overnight. The discovery of these animals came about with the ever-changing socio-economic and tech climate.

Here are some insights, on the more notable animals in the startup world.

I believe the unicorn status has reached such ubiquity that it’s hard to kill. The other labels seem to be either a response to global situations or a response to the shortcomings of unicorns.

If we dissect the characteristics of these labels further, we will find that they’re based on the same fundamental set of startup traits. There is a lack of clear distinction between these labels and one would be safe to assume that these labels were unjustified..

It’s just a trend.

Similar to how clothing labels come up with new fashion designs that trend. New startup labels come in trend over the years as well. However, there’s a little more science to why they came to be:

The Unicorn label came about in 2013, where startups were growing in valuation twice as fast as companies from startups founded before that. The growth was accredited to technological advancements, increase of private capital available and fast-growing strategies among other things during that era. Unicorns were once a rare breed, but in recent years, the stable of billion-dollar thoroughbreds has grown to about 350 unicorns around the world. In today’s world, unicorns represent more than a valuation figure. Rather, they represent a philosophy, an ethos and a process of building startups.

Fast forward three years in 2016, the Cockroach label crept up. During this period was where things got off to a very different start, with venture capital funding drying up amid wobbles for the global economy. This revealed problems in the business models of many unicorns and other fast-growing tech businesses. Most of which rely on VC money to fund their growth.

In the following year 2017, there was a realisation that unicorns were being rewarded for disrupting and razing non-profit and social enterprises comprising institutions like education, healthcare and journalism. This was when the Zebra label was introduced. The capital system at that point was failing society in part because it was failing zebra companies: profitable businesses that solve real, meaningful problems and in the process, repair existing social systems.

With the rise of “fake unicorns” with crazy valuations in 2018, the Rhino label entered the arena. It was the unicorn’s safer counterpart. SEA seemed to have the highest population of rhinos because it was entering the “golden age” of disposable income. Discretionary spending started to rise in a non-linear way and really great platform companies got built.

Fast forward to today in 2020, with the world facing a global pandemic, startups were one of the worst-hit groups of people. However, startups outside Silicon Valley seemed to be holding down the fort. In emerging markets, many companies have survived with less capital and ecosystem support. Thus, the label Camel came to be for their ability to adapt to multiple climates, survive without sustenance for months, and withstand harsh conditions.

What does this tell us?

That a slight change in the economic or tech climate might just bring on a new label that would most probably be attributed to another creature in the animal kingdom. But once again I believe it will just be another whimsical label covering the same narrative of “not being a unicorn.” As a founder, you should be more focused on being able to predict, identify and adapt to these ever-changing trends.

Labels offer no tangible value for founders

Why should we bother categorizing startups with labels if they offer no real tangible value? You might argue that these labels might give startup founders something to aspire to become or a way to model their startups after. But similar to religious dogmas and teachings, they all seem to converge in a similar end goal. All the models of these labels basically point startups in the right direction in terms of running and sustaining their operations. Whether you’re a startup unicorn or camel, your business is still being fueled by the man-hours and ingenuity you put into the company.

“Being labeled a unicorn is like being labeled sexy by People Magazine. It might be true to some, but it’s based entirely on perspective.” (startups.com)

If you’re a founder and you’re chasing a label for the hype and buzz it creates then you may have to reevaluate your decisions. Many startups have crumbled under the hype and the buzz because they were focused on impressing their stakeholders and the media rather than focusing on their product and people.

One such startup that took that path was Theranos Inc, a consumer healthcare technology startup, was once valued at $10 billion at its height in 2015. Its leadership claimed it would revolutionize the blood-testing industry. However, the technological breakthrough that CEO Elizabeth Holmes and former company president Ramesh Balwani touted was never demonstrated, and the assertions of Holmes and Balwani amounted to outright deceit. The company raised more than $700 million by deceiving investors for years about the company’s performance. At the end of this saga, Holmes lost control of the company, returned millions of shares, and was barred from serving as an officer or director of a public company for 10 years.

The type of culture labels like unicorns breed has crept into the whole ecosystem in the most horrific way. Now, other startup founders also want the unicorn status and they are not shy to take the short-cut, or worst, the unethical route.

Chasing this proverbial label clearly seems to be doing more harm than good for founders in recent years.

It’s not about the label it’s about the business

Now don’t get me wrong. Not all startups aspiring to be the next big thing are destined for failure. Just like how we all have unique thumbprints, startups have their own unique business models and processes. They’re all running their individual races and they reach the finish line in their own unique ways.

Take the building and construction industry for example. You don’t see companies like Whiting-Turner on unicorn lists but yet companies like theirs have accrued billions in revenue without outrageous valuations. And that’s simply because they don’t fit in the prescribed label by definition.

So what are companies like theirs and many others doing right and what should startups be focusing on? I believe startups should be focused on the stuff that matters, like the following business fundamentals:

Revenue and profitability: The most common problem for startups is that they often do not have a clear path to profitability and return on investment. If your startup is focused or has a proven track record of actually building and scaling a customer base and bottom line then you’re already a step ahead from the others. Others being those that are less focused on the essentials and that are riding on their “innovative” concepts to rake in the dollars and customers.

Business model: For a business to grow and succeed, it needs a strong backbone. A business model helps you define your customer value proposition and pricing. It provides a helpful guide on how to organise your business, whom you should partner with to generate revenue, and how to structure and manage your supply chain accordingly amongst other things. Figuring out the right combination of partners, practices, and platforms isn’t easy. Getting it wrong is why so many startups fail. Likewise, getting it right is essential. Investing in things that truly matter like infrastructure and employees is a true indicator of vision and sound decision-making in a startup.

Sustainability: The market is actively looking for reasons to doubt billion-dollar-or-higher valuations. It’s important to take a step back and evaluate things like customer sentiment, potential for brand growth, how well users respond to products, leaders’ pedigrees and track records, and so much more. That takes closer scrutiny and patience. Developing a resilient backbone indeed takes time, but in the end, it’s the type of framework that’ll weather turbulent market conditions and allow companies to go the distance.

Much the way all wildlife isn’t the same, all labels don’t share the same degree of long-term promises. No one’s interests are best served by prescribing a one-size-fits-all outlook to such a wide breadth of startups. Thus, focusing on the above-mentioned fundamentals should be the right approach moving forward.

The way forward

Startups are not cockroaches, unicorns, camels, or rhinos— they are made by a group of people who can spot opportunities that others are not able to see yet and these people usually challenge the status quo. Building a successful startup is about grit, years of sacrifice, anticipating market volatility, managing the risk and, of course, a bit of luck.

Regardless of the labels used, there needs to be a change of focus in 2020. We need more founders focusing on startups that can actually be more self-sufficient or at least rely less on VC funds instead of dreaming and boasting about becoming the next unicorn. Instead of chasing after the labels, it’s high time we talk about becoming a fund-returning, profit-rich startup.

With innovation and tech growing at an unprecedented pace, no two startups can be described the same or be compared apple to apple. Our entrepreneurial journeys are unique to one another. That’s all the more reason to be cautious about the terms we use to describe startups. In today’s environment, generalizing is both easier and more counterproductive than ever. I believe we can do better by simply shifting the focus away from the labels and double-down on what truly matters; building, growing and sustaining your business.