Here at StartupX, we’ve been fortunate enough to work closely with several different stakeholders of the SEA business community. This article is part of our series attempting to share some of the knowledge we’ve developed to help bring about more informed business decisions as we all look to emerge from COVID-19 better and healthier.

Against the backdrop of the COVID-19 pandemic, Healthcare was — and continues to remain — the undisputed need of the hour; and as the tech revolution goes mainstream, we’ll be deep-diving into HealthTech today.

What is HealthTech?

Healthtech is the fastest-growing vertical within healthcare. It includes essentially any tech-enabled healthcare product or service that can be consumed outside of a hospital or physician’s office. Companies that seek to optimise or enhance the actual ‘delivery’ of healthcare also fall under this vertical, such as an app that helps you meditate, or an e-insurance network that provides telemedicine consultations.

Investment Figures

As per Galen Growth, digital health ventures raised $25 billion in VC funding alone (up 34% YoY), in the highest-ever funding year for the industry. When you also factor in the quantum from exits, the total deal value closed at $71 billion, 3.2x higher than 2019! CVCs also were privy to this trend, with digital health funding rising 68% to reach $8.8 billion in 2020, thanks in no small part to mega-rounds (up 170% YoY).

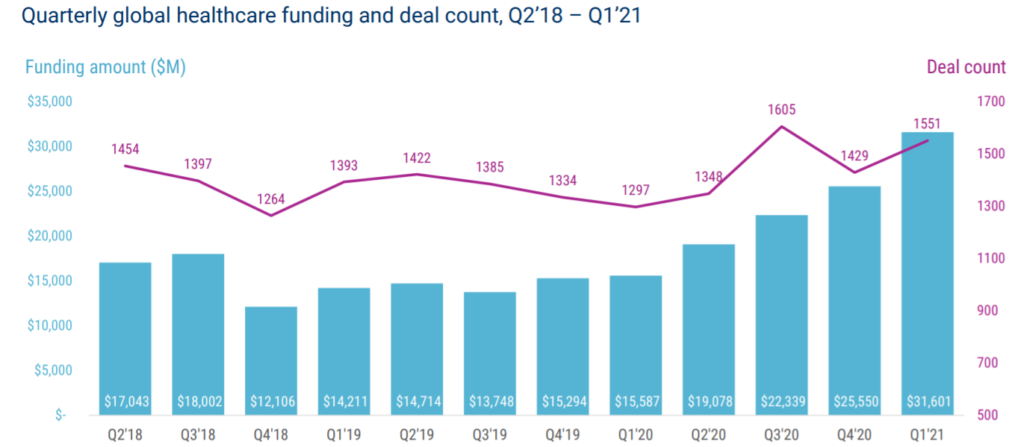

(Image embedded from a CBInsights report)

CB Insights showed that the strong momentum has carried forward to 2021, with the Q1 figures marking a 23.68% increase QoQ, in the largest single-quarter funding figure in healthtech’s history. Across regions, the US accounted for a whopping 68.6% of the total invested amount, followed by APAC at 24.7%. European key markets and the Middle East combined accounted for a meagre ~6.7% in comparison.

Within APAC, China’s started off sluggishly, with H1 2020 VC investment amount sinking to its lowest figure since 2016. However, the nation’s relatively early reopening and economic recovery saw them bounce back to account for 80% of the total investment dollars come the year-end. Other regions in APAC weren’t as fortunate, with investments decreasing across South Asia (40% YoY), North-East Asia (23% YoY), and SEA (5% YoY).

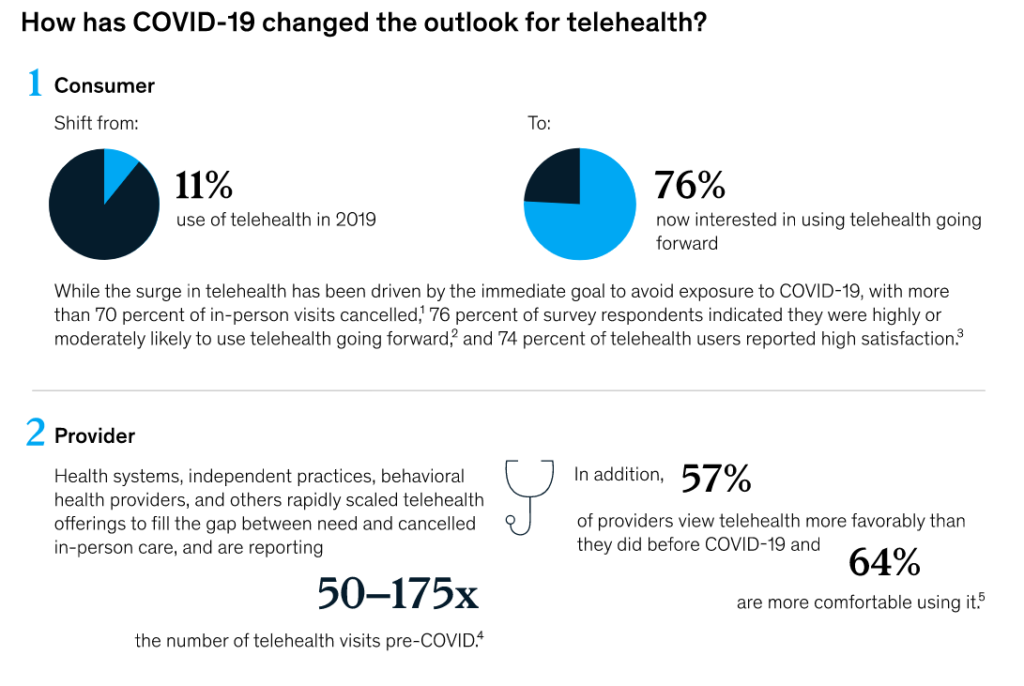

(Image embedded from a CBInsights report)

2020 also continued the ‘HealthTech IPO Boom’ created by Livongo in 2019, as 8 companies went public — that’s more companies in one year than those that went public from 2015 through 2018 combined. Investor sentiment is that maturing companies, coupled with the ubiquity of ‘accelerated’ paths to going public (most notably SPACs) should see 2021 follow in similar footsteps.

For many people in this space, they invested in trend lines this year that were already a part of their strategy. It’s like we’ve seen five years of natural evolution turn into three quarters of revolution. Many people were already believers and investors in digital health, and to see fruits of the labour is really exciting.

– Lynne Chou O’Keefe, Define Ventures

Noteworthy Trends and Stats

Telehealth

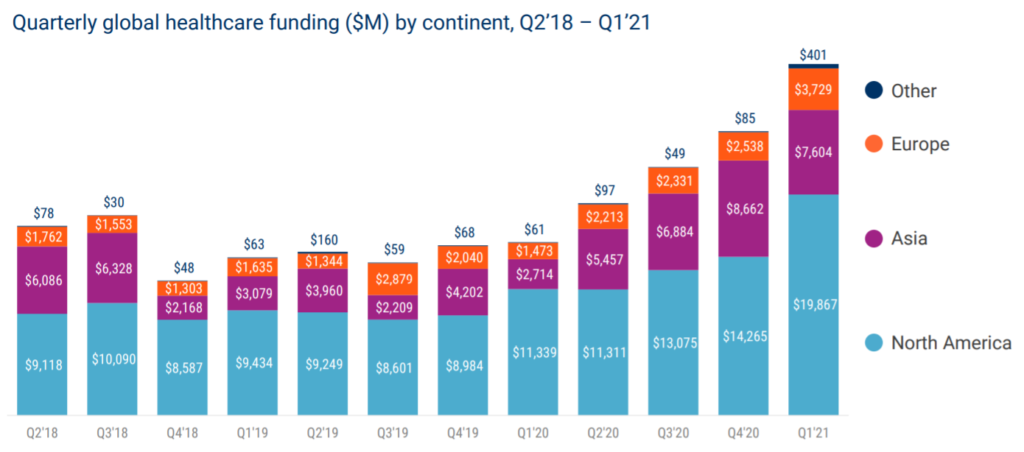

Telehealth — the provision of tech-facilitated remote healthcare — saw its highest-ever funding year in 2020, with $10.45 billion raised (up 39.5% YoY) to become the highest funded category of the year. It continued its strong momentum into 2021 with Q1 ’21 marking the highest investment figure ($4.2 billion) of the last 12 quarters.

Telehealth adoption statistics were up wherever you look; by December 2020, 58% of countries had replaced face-to-face consultations with telehealth alternatives. Roughly 84% of Europeans using telehealth services when the pandemic began were doing so for the first time in their lives; in the US, 46% of patients said they now use telehealth for some visits, up from 11% in 2019; In APAC, the change in the number of insurers who indicated that none of their insured members used telehealth services fell drastically from pre-pandemic levels (56%) to today (4%).

(Image embedded from a McKinsey article)

Mental Health

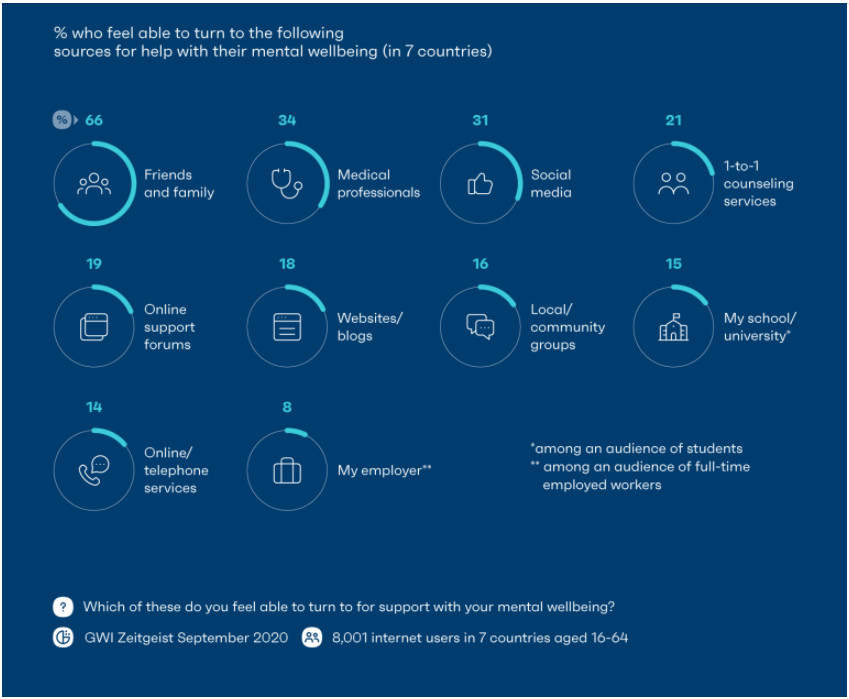

Global lockdowns, coupled with radical changes to work and education, put mental health on the centre stage. 51% of consumers chose “time for me” as one of their top 3 priorities in life, a figure almost 2.5x higher than 2017 levels. The fact that one survey showed consumers putting “mental wellbeing” (31%) as a higher concern than “access to a vaccine” (29%) really says it all. In response, several mental health companies rose to prominence, as funding levels rose from 275% QoQ in Q1 ’20 and stayed roughly consistent for the entire year, before once more rising 53.8% QoQ in the first quarter of this year.

Lyra established that approximately 50% of employees now have higher expectations regarding mental health from their employers. Similarly, groups characteristic of students in hostels and IHLs were among the most susceptible to disturbed mental health. However, strides still need to be made by both segments on this front, as universities and employers rank 3rd-last and last respectively, among people one can turn to for help and support.

(Image embedded from a Lyra article)

Companies Making Waves

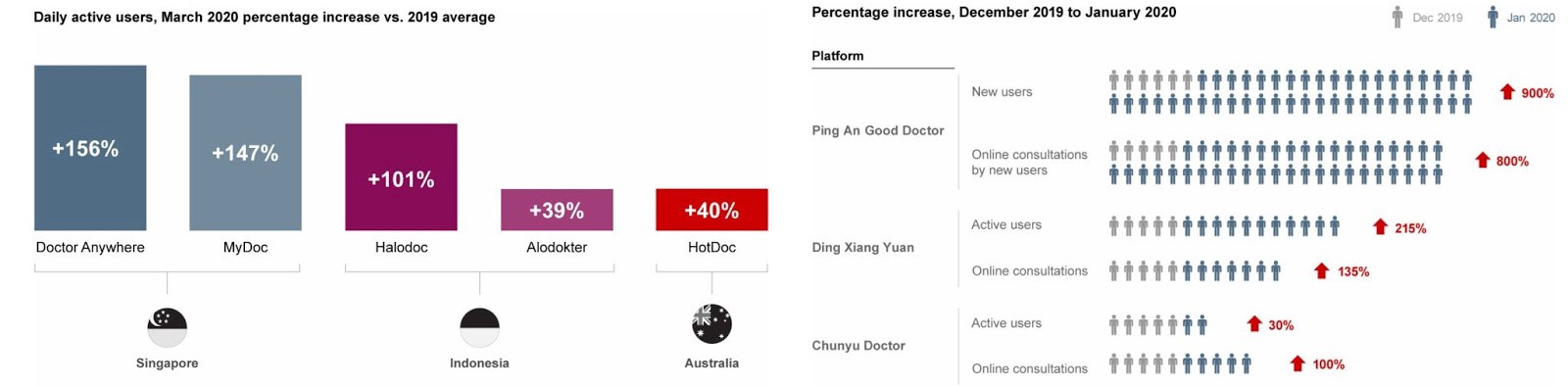

To say that healthtech rose to the occasion in a time of crisis would be an understatement. Fear did drive some providers’ metrics to record numbers during the infancy of the pandemic; just consider how China’s e-healthcare figures skyrocketed in a very short window, on the back of their being the first nation to brace the novel coronavirus’s brunt.

(Images embedded from a Bain & Co. article)

However, with the passage of time, mental health took centre stage as people accepted global lockdowns to be their new norm. One prominent company in that department is Ginger, which closed its $100 million Series E raise in March 2021. Operating a B2B2C model, Ginger has expanded its presence to over 10 million users, en route to serving a demand figure 3x higher than pre-pandemic levels. Credibly, their average sign-up rate is also over 200% of the US national average for employee assistance programmes.

Also fighting this noble battle are Lyra (raised a $187 million Series E), Better Up (raised a $125m Series D), and several early-stage companies seeking to expand access and uptake.

Impact on Key Stakeholders + Going Forward

Hospitals and patient-data storage providers

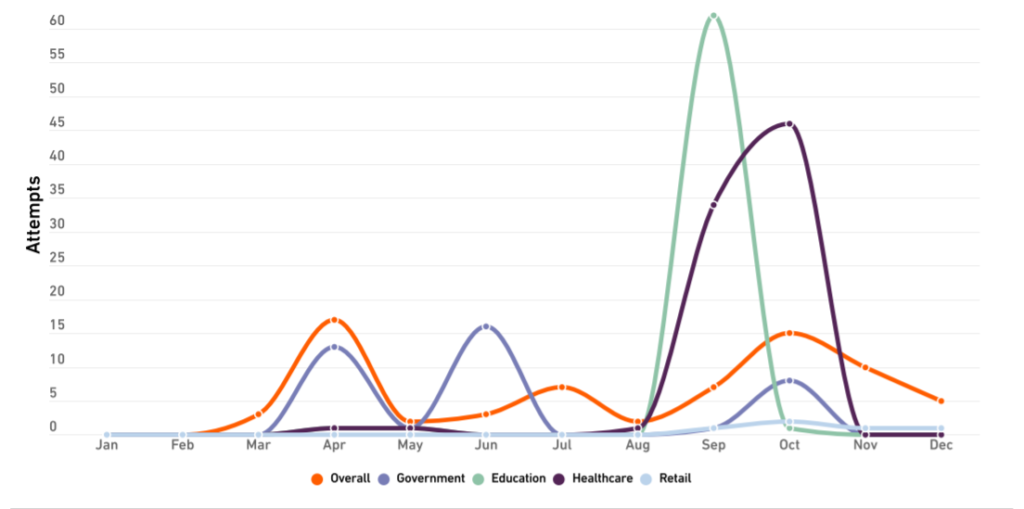

Recent years have seen high interest in IoT security providers, including those for medical devices and systems, especially in the wake of recent ransomware attacks on hospitals. It is astonishing to note that 82% of healthcare organisations implementing IoT systems experienced a cyberattack in 2019, with patient data being the overwhelming concern. Further, the number of ransomware attempts against the healthcare industry rose by 123% in 2020.

Cybersecurity was one of the most resilient sectors vis-a-vis investment during the pandemic, and even in a flourishing market, founders and operations managers need to be doubly cautious and proactive when it comes to the defence of their data.

(Image embedded from a SonicWall report)

Investors

Healthcare traditionally hasn’t been the quickest adaptor of technology, for very understandable reasons. However, the pandemic forced a nitro-boosters level thrust forward, led by veteran/repeating investors, who accounted for 60% of all investors. The general sentiment remains that this isn’t a bubble, but rather a sustained period of investment — this is in keeping with the fact that £3.79 billion has been invested (between January and April 2021) into tech companies with innovations specifically related to pandemic protection/preparedness, a trend set to continue for the coming “COVID decade”.

While there has definitely been a flight to quality in terms of more established and proven players receiving more funding, early-stage ventures delivering innovative and disruptive models should see an availability of dollars as the pandemic recedes and investors’ risk-appetites reappear.

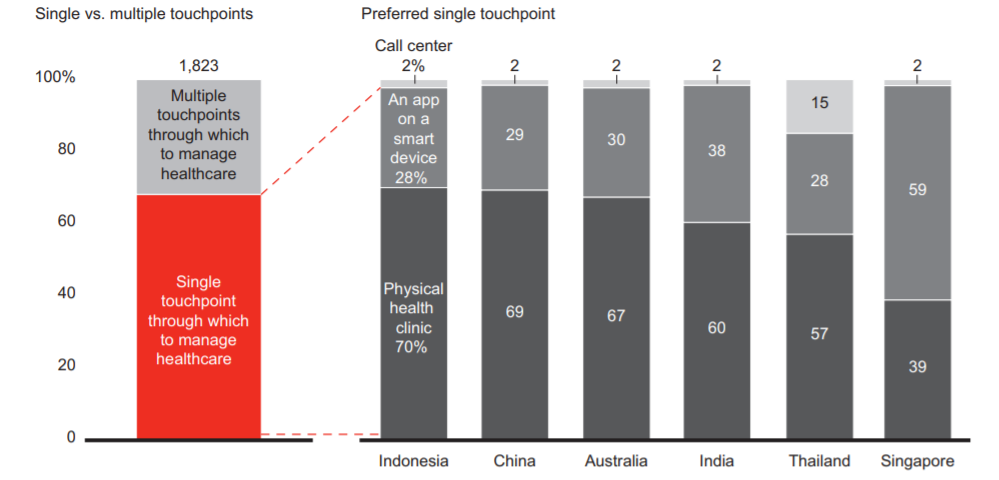

Consumers, Physicians and Platforms

A very interesting trend in Asia-Pacific is consumers’ desire to have just a single consolidated touchpoint for all their healthcare needs. 7 in every 10 consumers would prefer to manage one single avenue when it comes to healthcare. While it seems like a far cry from today’s systems, I find this extremely intriguing as it could pave the way for movements, consolidation, and perhaps even completely new delivery models. Consultations, pharmacies, mental health help, and possibly even insurance could be localised, instead of the siloed approach prevalent today.

(Image embedded from a Bain & Co. report)

Different geographies are wide apart in their preferences of physical v/s super-app formats. Singapore and India lead the ‘digital’ pack, with Indonesia, China and Thailand being the ones preferring brick-and-mortar. Only time will tell how physicians, healthcare providers and insurers alike respond to this.

In conclusion, the response to the pandemic has been one which even Harvey Specter would have been proud of. Best exemplified by the development of vaccines in record time, the pandemic showed how a sector that is highly regulated and relatively skeptical of mass-digitisation blossomed on the back of reception to new technologies, and global cooperation. Providers who can show adaptability, versatility and regard for data security would be best suited to emerging from the pandemic with a stronger foothold in the game.