What is corporate innovation

A pile of rocks ceases to be a rock pile when somebody contemplates it with the idea of a cathedral in mind.

Corporate innovation is the process by which companies leverage on ideas to improve and disrupt existing products, processes, models and methodologies, and in today’s fast-changing world, it has become almost a necessity for every corporate to innovate in order to stay relevant, competitive and indeed, sustainable.

(Image embedded from Medium article)

Corporate innovation has become an increasingly important segment of corporate work in general, as companies are being forced to innovate to stay relevant and competitive. Just consider how 52% of Fortune 500 companies have either “gone bankrupt, been acquired, or ceased to exist as a result of digital disruption” since the turn of the century. Moreover, the average life expectancy of a company on the S&P 500 index used to be 61 years back in 1958, but has reduced to sub-18 years today. What’s more, 50% of the names on the current list will be replaced over the next 10 years.

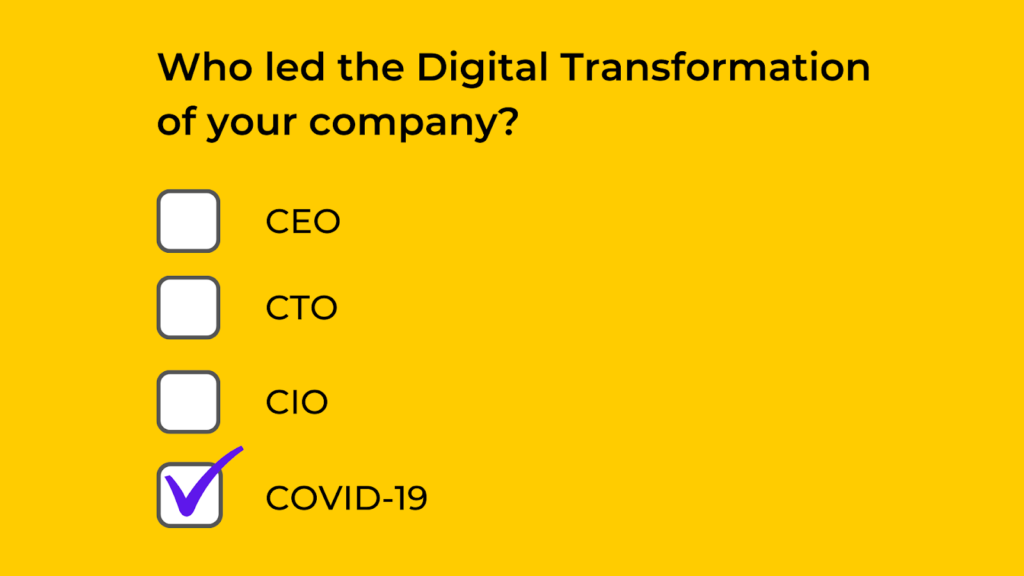

The COVID-19 pandemic is changing both consumers’ tastes and preferences, and companies’ ways of doing business as we speak, and because of this, corporate innovation is now a necessity for any and every organisation that wants to emerge from this black swan event with a viable business. 90% of executives surveyed by McKinsey believed that the COVID-19 will fundamentally change the way they do business over the next half-decade, and 85% estimate that it will have a lasting impact on their customers’ desires over the same period. That being said, nearly three of every four executives believes this provides an avenue for growth, with technology being the most optimistic sector of the bunch.

(Image embedded from McKinsey article)

As companies grow larger and larger, they also become slower and slightly more hesitant in transforming and adapting to changes, as their scale makes organisation-level change a barrier. Hence, they build out existing products and models, but that can only get them so far. On the other hand, startups are traditionally seen as agile, proactive, and responsive to changing market conditions, and thus the perfect embodiment of the word ‘innovation’.

Corporate innovation thus means different things to different companies, but all of them have one thing in common – they usually involve working with startups to leverage their technology, vision and appetite for disruption. In this article, we will look at where the venture arms of established corporates (Corporate Venture Capital units, or CVCs for short) and traditional VC firms have pledged their investment dollars, and follow the money to unearth key markets and trends.

Technologies are being stretched to their limit. Non-traditional approaches will enable the next rebound of innovation and efficiency.

– Mr. Darry Plummer, VP and Distinguished Analyst at Gartner

The state of play for VC and CVC investments:

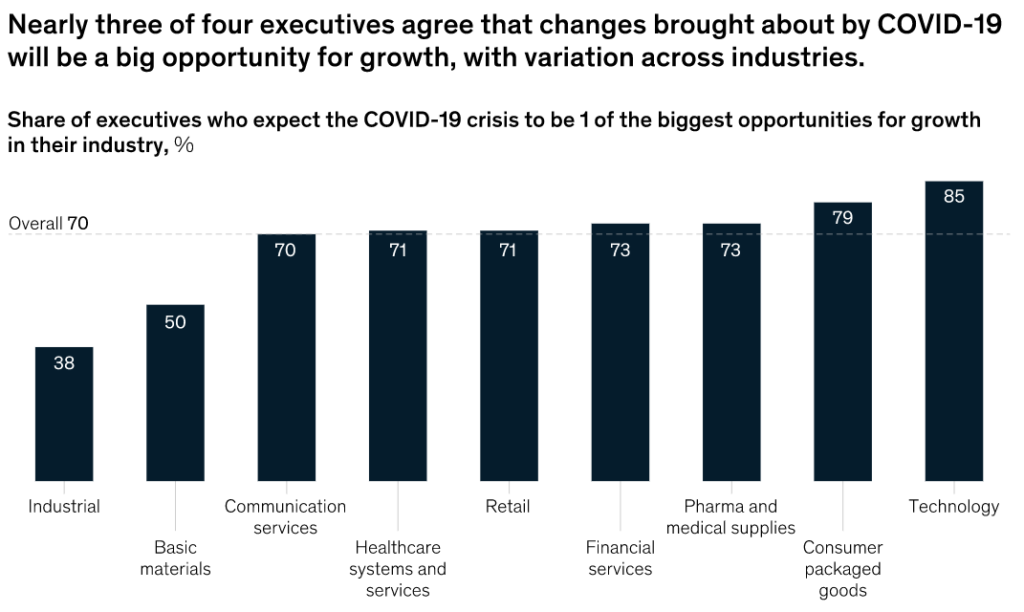

Following the dollars painted the picture of CVC-backed funding reaching as high as $73.1 billion (as per CBInsights’s 2020 Global CVC Report) in 2020, a 23.68% rise from 2019, achieving an all-time high. At the same time, however, the total number of deals sanctioned fell (albeit only by a mild 1.7%), on the back of COVID-19 causing a severe economic downturn in the earlier half of the year.

(Image embedded from CBInsights’ “The 2020 Global CVC” Report)

Similarly, traditional venture capital (VC) investors also pumped a little over $156 billion into startups across all industries, a feat that marked the third straight year that investors deployed over $100 billion into startups, and one which topped the previous high of $120 billion invested during the dot-com bubble of 2000. In traditional VC too, the total number of transactions was down year-on-year.

Both these facts suggest that venture investors, in general, opted more for quality over quantity, providing their investee companies with more money per round than ever before. In keeping with this trend, we found that both CVCs and VCs pulled back from early-stage deals and preferred to put their capital towards late-stage deals (Series C and beyond) instead, intuitively because amidst times of great uncertainty, investors raced to pump money into proven organisations with an existing customer base and concrete traction.

Indeed, the upshot of mega-rounds (Rounds in which $100m or more capital is raised) sums this up perfectly. Mega-round investments were up for both CVCs and VCs, by 48% and 33% YoY respectively. The flip side of the coin saw seed and angel stage valuations sink by 7% and 17% respectively.

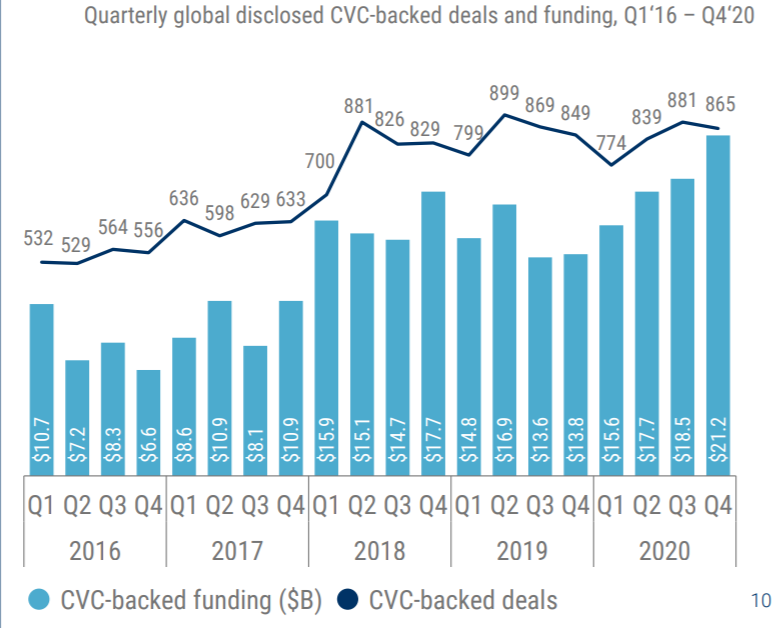

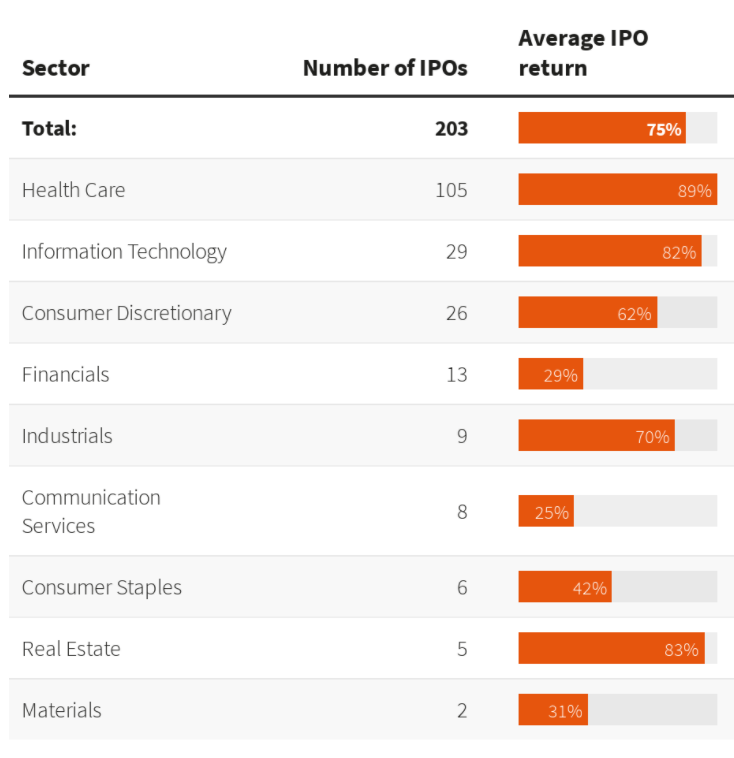

It was also a triumphant year for VC exits, as 102 IPOs took place to drive home $222 billion worth of exits, and spearheaded a 13% YoY increase in the overall exit value, despite the number of exits slowing by 17%. In the same boat were SPACs (Special Purpose Acquisition Companies), providing companies with a more streamlined route to going public; gaining momentum in the second half of the year, 250 SPACs were formed (5x more than those in 2019), and they raised more than $75 billion (5.8x more than in 2019).

(Image embedded from TrueBridge’s “State of the Venture Capital Industry” Report)

The returns and proceeds really highlight what a strong this year was, especially in the second half as tech and biotech bounced back given their demand in the pandemic. As the pandemic raged across the economy, investors turned to software companies and health care companies.

– Mr. Matt Kennedy, Senior strategist at IPO research firm, Renaissance Capital

(Image embedded from a Reuters Article)

A brief overview into some of the industries

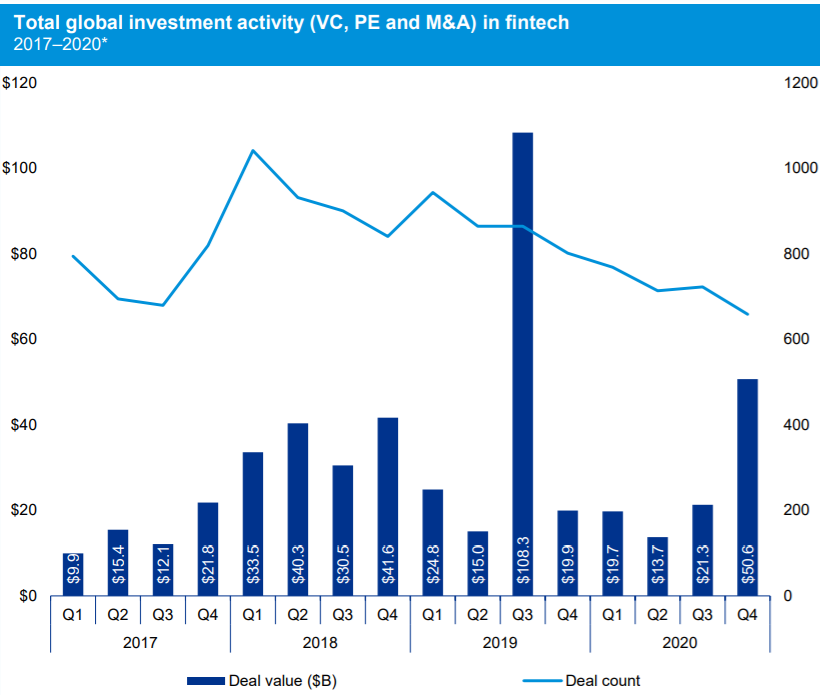

Fintech was one of the sectors that saw a considerable drop in the first half of 2020, but rebounded extremely strongly in the second half, as people of all ages looked to safeguard their capital and become financially literate. A lot of youngsters took to equities trading, with major online brokers such as Charles Schwab, TD Ameritrade, and Robinhood (who recently suffered a huge fall in public eyes for their response to the r/wallstreetbets short-squeeze saga) seeing new accounts grow as much as 170% in Q1, when stocks experienced the fastest bear market and the worst first quarter in history. This is best exemplified by the fact that Q1 2020 included 27 of the 30 highest volume days in Schwab’s history.

Total investment in the fintech space crossed $150 billion globally, with the 2nd half of last year accounting for 68.47% of it. It marked the 3rd highest total investment year ever, and the second-highest for VC investment specifically. Payments, eCommerce and cybersecurity were touted as some of the most resilient verticals that thrived on the back of the pandemic. Interestingly, while both the Americas ($23 billion) and EMEA ($9.2 billion) regions saw record highs of annual fintech-focused VC investment, APAC dropped to its lowest level since 2014, at $11.6 billion. The uncertainties surrounding COVID-19 in the region is reported to have driven investor confidence away from “emerging markets like Southeast Asia”. Online payments and (in China and India’s case) insurtech have provided some reason for hope. KPMG expects the fintech investment levels to persist in 2021.

(Image embedded from KPMG’s “Pulse of Fintech H2’20” Report)

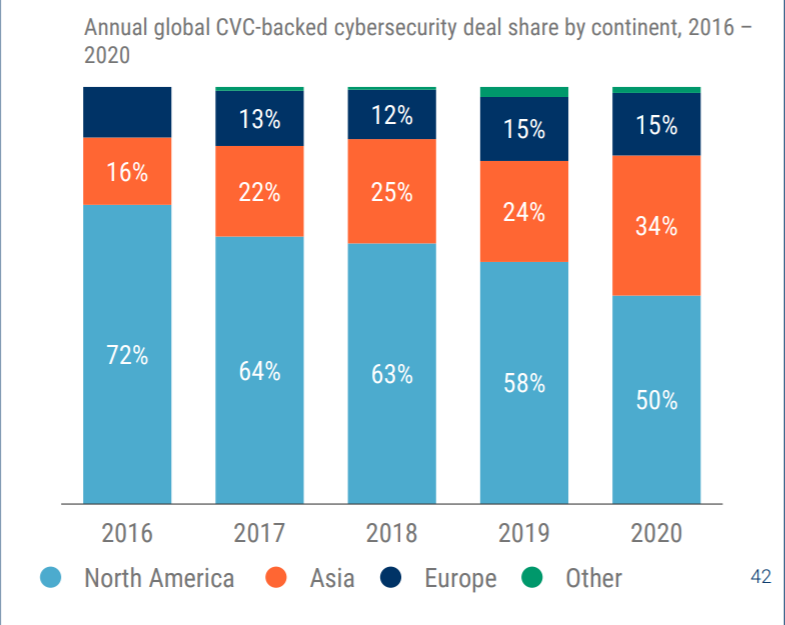

Interestingly, cybersecurity was one of the verticals that propped up. CVC investment in the area touched a record high of $3.8 billion in 2020. The trend towards a higher quantum of money being shelled was exhibited strongly here too, with mega-rounds with CVC participation growing 100% YoY from 6 in 2019 to 12 in 2020. Despite accounting for a much smaller share of the fintech pie in general, Asia gained deal share (Up 10 percentage points from 2019 levels) in this market, at the expense of North America (Whose share fell by 8 percentage points). Israel emerged as the nation recording the 2nd most funding in the space, with a staggering 20% of the country’s venture dollars going towards cybersecurity.

2021 looks to be on course to capitalise on this trend. This is largely owing to the recent SolarWinds cyberattack, which is an extremely worrying catalyst for firms to spend more money to safeguard their and their clients’ personal information via state of the art security systems. Similarly, with the heightened usage of medical facilities, securing patient records is a growing priority. IoT security providers are expected to grow in demand, owing to the complexity of the systems due to the sheer number and variety of moving pieces.

(Image embedded from CBInsights’ “The 2020 Global CVC” Report)

Founders and investors alike have been forced to scramble, pivot and think outside the box in the most challenging of years. Naturally, some industries/markets have prospered, whereas some have been put firmly on the back burner. In the coming few weeks, StartupX will be deep-diving into a set of industries that have made waves on the back of COVID-19, and which look set to emerge from the other side better, stronger, and armed with a much larger war chest to take to market. Stay tuned to find out which they are!